Invest In Your Future. Invest In Us

As StartupIndia Recognised Company we are expanding our wings and searching for Investing in India’s Semiconductor Sector in 2023

Hadira Technologies Private Limited is situalted in the heart of financial capital of India Mumbai being registered firm since 2018. We have immense knowledge and experience of minimum 24 years in this IT field since 1999. We know every small to big IT companies of India. Since we know how important and profitable is semi condutor field in India and around the globe. We know where we can have our corporate office and where factory will be build this job is very long and tiring and require millions of dollars. But when an foreign company collaborate with us we know how to deal with law and regulations of India since we are reputed company of India and running our business successfully. Every foreign company wants to invest in India and it is huge and growing market and we guarantee you that we will acheive tremendous height and can acheive our goal with us.

Below is the another brand which we are running

In FY 2023, India received equity inflows worth US$46.03 billion

Foreign direct investment (FDI) in India’s semiconductor field can be a significant opportunity for your company. India has been actively encouraging FDI in various sectors, including electronics and semiconductors, to promote economic growth, technological advancements, and job creation.

Welcome to Hadira Technologies Private Limited’s dedicated page for semiconductor investment in India in 2023. As a StartupIndia Recognised Company, we recognize India’s immense potential and opportunities. With a rapidly growing market, a supportive government, and a skilled workforce, India is an ideal destination for foreign direct investment (FDI) in the semiconductor field.

Why Invest in India’s Semiconductor Sector?

- Thriving Market: India’s domestic semiconductor market is experiencing robust growth, driven by increasing demand for electronics and emerging technologies such as AI, IoT, and 5G. By investing in India, your company can tap into a market poised for substantial expansion in the coming years.

- Government Support: The Indian government actively encourages FDI in the semiconductor industry through various initiatives and policies. The “Make in India” campaign, the National Electronics Policy, and the Production Linked Incentive (PLI) scheme provide attractive incentives and support for companies looking to establish manufacturing facilities, R&D centers, or design hubs in India.

- Infrastructure Development: India is committed to building a robust semiconductor manufacturing ecosystem. The government has identified strategic locations for semiconductor fabs and is offering incentives such as tax benefits, subsidies, and access to infrastructure facilities to attract investments in this sector.

- Skilled Workforce: India boasts a large pool of talented engineers, many of whom specialize in electronics and semiconductors. By investing in India, your company can access this skilled workforce, fostering innovation, research, and development through us.

- Collaboration Opportunities: India has a strong network of research institutes, universities, and technology parks that encourage collaboration between academia and industry. By investing in India’s semiconductor sector, your company can engage in fruitful partnerships and leverage these collaborations to drive technological advancements and product development.

How We Can Help:

At Hadira Technologies Private Limited, we have a proven track record in the semiconductor industry, with extensive experience in manufacturing, R&D, and design. Our expertise and global network enable us to navigate the Indian market effectively and capitalize on the opportunities it presents. By partnering with us, you can leverage our knowledge, resources, and established relationships to establish a successful presence in India’s semiconductor landscape.

Contact Us:

If you are interested in exploring investment opportunities in India’s semiconductor sector or have any queries, we would be delighted to assist you. Please reach out to our dedicated team at [email protected], and we will be happy to provide further information, discuss potential collaborations, or arrange a meeting to discuss your specific investment needs.

Disclaimer: The information provided here is based on available knowledge up to March 2023. Please consult relevant authorities and experts to obtain up-to-date information before making investment decisions.

Our Achievements

StartupIndia Recognised Company

We are very few companies in India who is StartupIndia recognized thru DPIIT.

Section 56(2)(viib) of the Income Tax Act

Section 56(2)(viib) of the Income Tax Act provides that where a closely-held company[1] issues share to a resident investor at a value higher than the “fair market value” of such shares, then the excess of the issue price over the fair value will be taxed as the income of the issuer company.

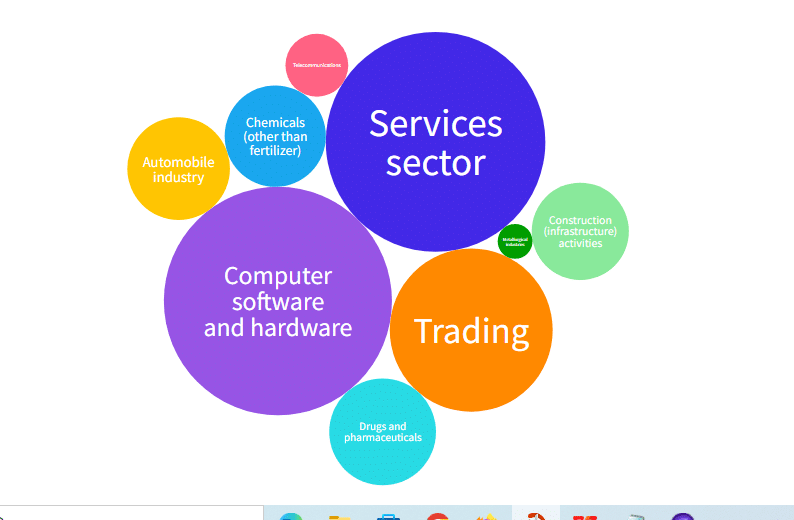

Sector-wise Distribution of FDI Inflows in India FY 2023 (US$ Million)

This picture from a Reuters source confirms that the semiconductor market is having huge demand in India and can flourish if gets funded

Manage Estate Planning

Remember, estate planning is a complex and individualized process. It is important to consult with professionals who can provide personalized advice tailored to your specific situation and objectives. But if we are connected with any company all Indian laws and regulations will be handled by our experts. Since we are Government StartupIndia Recognized company so many complex laws won’t apply to us.

FORM 80 IAC (TAX DEDUCTION ELIGIBILITY CERTIFICATE)

The most Important factor of guaranteed success if you invest in our company is that we are an 80-IAC certified company in this the Startup can avail of tax holidays for three consecutive financial years out of its first ten years since incorporation.

Partnership Risk Management

“Effective risk management is essential for foreign semiconductor investments in India, encompassing political, regulatory, economic, market, operational, IP, compliance, partner/vendor, cybersecurity, financial, and currency risks.”

Growth Mergers & Acquisitions

Merging with Hadira Technologies Private Limited in India can drive growth, technological advancements, and market expansion. Careful planning, due diligence, effective communication, and strong leadership are key to a successful merger. Engage with experienced advisors, including legal, financial, and integration experts, to guide you through the merger process and maximize the benefits of the combined entity. This a tedious task we can do by joining hands and making this sector a huge profitable for both of us

Contact

Get In Touch

If you have any specific questions or need assistance regarding the semiconductor industry in India or Indian Market or related topics, feel free to ask, and I’ll be glad to help.